The business opportunity.

Purpose, profit, and the power to make a difference.Discover the incredible opportunity of running your own CareYourWay Franchise and the potential it offers for you, your family, and your loved ones.

A resilient, rewarding industry.

The home care sector is unique: deeply human, purpose-led, and built around one clear mission to deliver outstanding care.

The care industry is both strong and resilient. Our model has withstood a national recession and a global pandemic, proving its durability in uncertain times. Through various economic challenges, it has stood the test of time, showcasing its resilience over decades of service. This, without a doubt, makes the sector highly attractive. The social care industry is also resistant to the rise of AI.

Many are naturally drawn to giving back, and the care industry not only offers strong financial returns, but also provides a genuine opportunity to make a real difference.

The brand's home care services.

Discover the service types that our franchise partners can provide in their local area.

The ageing population.

As of 2025, almost 11 million people in England are aged 65 or over. Of these, around 5 million are aged 75+, and 1.4 million are aged 85+. According to the Office for National Statistics, around half of all one-person households in the UK (totalling 8.4 million) are occupied by someone over the age of 65. With people living longer and health care continuing to advance, the demand for high-quality home care services is growing rapidly.

Supporting the NHS: ready for change.

CareYourWay is actively preparing for the evolving landscape of health and social care. In 2025, the government introduced a 10-year NHS plan that highlights key priorities such as hospital-at-home models, virtual wards, and strategies aimed at easing pressure on NHS services. In response, CareYourWay is committed to supporting the NHS by driving continuous innovation and harnessing the latest technology to deliver care that helps reduce demand on hospitals.

There's no place like home.

More older adults than ever are choosing to stay in their own homes as they age, with the vast majority expressing a strong preference for ageing in their own environment. Residential care placements have been steadily declining, while demand for live-in care, home adaptations, and personalised support at home continues to grow. This shift highlights home care as the preferred and increasingly essential model for later-life support.

Franchising really works in health and social care.

Franchising offers a proven, lower-risk route into the health and care sector. In the UK, 93% of franchises are still trading after five years (BFA/NatWest), far outperforming independent start-ups. Health and care is a demanding industry, so having the backing of a trusted brand and expert support makes all the difference. With a tried-and-tested model behind you, you’re never in it alone.

The future of home care.

The UK home care market is expected to grow significantly over the coming years, driven by demographic shifts, rising care needs, and a strong move away from residential settings. By 2038, the number of adults aged 65+ requiring care is expected to rise by 57% compared with 2018 (Health Foundation). At the same time, capacity in traditional care homes is failing to keep pace — with fewer than 100 additional beds added across the UK in 2024 (Financial Times). This shortfall is accelerating demand for high-quality care delivered in the home, making the sector one of the most future-proof industries.

Why choose franchising?

Franchising offers the chance to run your own business while benefiting from the support of an established brand. You get the freedom of being your own boss, backed by a proven business model that’s been honed for over twenty years. A British Franchise Association’s (BFA) survey underscores the exceptional success rates of franchises in the UK, with a remarkable 99.5% succeeding — standing in stark contrast to the 50% failure rate of independent start-ups during the same period.

Having run our own home care business since 2005, we understand exactly what’s needed to succeed. From day one, you’ll have access to ongoing support, training, and guidance, with someone always on hand to offer advice or assistance whenever you need it.

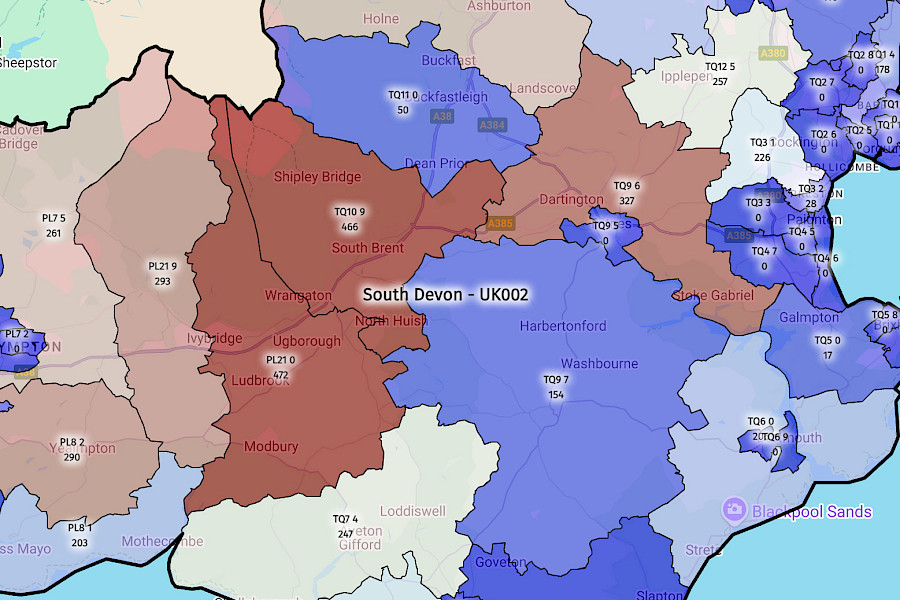

Territories that drive results.

We understand the power of data – which is why we invest, every month, to provide franchise partners with the latest insights and demographics.

Imagine knowing exactly where your ideal clients are based. Imagine having clear guidance on where to focus your recruitment efforts. We’ve partnered with expert mapping specialists to give you access to an incredible depth of data, designed to help you make smarter, more strategic decisions and drive the best possible results.

And because we’re still a younger brand, there are plenty of prime territories available.

The financials.

A dedicated, hard-working franchisee following the system, marketing the business successfully, recruiting well and building a strong reputation in their local area may see turnover of £200,000–£400,000 in Year 1, £600,000–£700,000 in Year 2, and £1 million+ in Year 3 depending on their area and territory. However, franchisee performance cannot be guaranteed and franchisees should always conduct business planning to set their own expectations.

*We cannot guarantee any level of success and the success of your franchise is dependent on your ability to scale it.

The investment.

The typical investment to launch a CareYourWay franchise is around £100,000 to £120,000, though this can vary depending on personal circumstances.

This includes a £39,500 + VAT franchise fee, with the remainder allocated as working capital to help float the business in its early months. Finance options are available, and we’ll support you in exploring the right funding solution for your journey.

Franchise partners receive ongoing support with both internal and external business planning, and additional funding or finance options may be always available if needed.

Funding your franchise.

CareYourWay franchise partners can access up to 70% funding to support their investment, and we’re proud to hold a 100% funding success rate to date. We maintain good relationships with most major high street banks and work in partnership with a specialist third-party funding company who guides each applicant through the process from start to finish.

All projected costs are built into the business planning process, with multiple funding formats available — including traditional bank finance and relevant government-backed schemes. As part of our support, every prospective partner is offered a free pre-qualification finance call.